“I always say it but particularly over the past couple of years, our customers are increasingly having to do more with less people,” that is Jaama managing director Martin Evans’ opening gambit in our conversation. It is a grim reality but he is right.

Pukka fleet managers have been on the wane for years, and their responsibilities increasingly fall to non-specialists in other departments, such as HR or finance. Either that or once-hearty fleet teams just get smaller.

It also explains why the industry is ever more reliant on external specialists, so it makes sense that 2021 was the fleet software company’s best-ever year. New additions to its client base comprised of two of the UK’s 50 biggest leasing companies (it now works with 12 of them) and 15 rental firms and fleets.

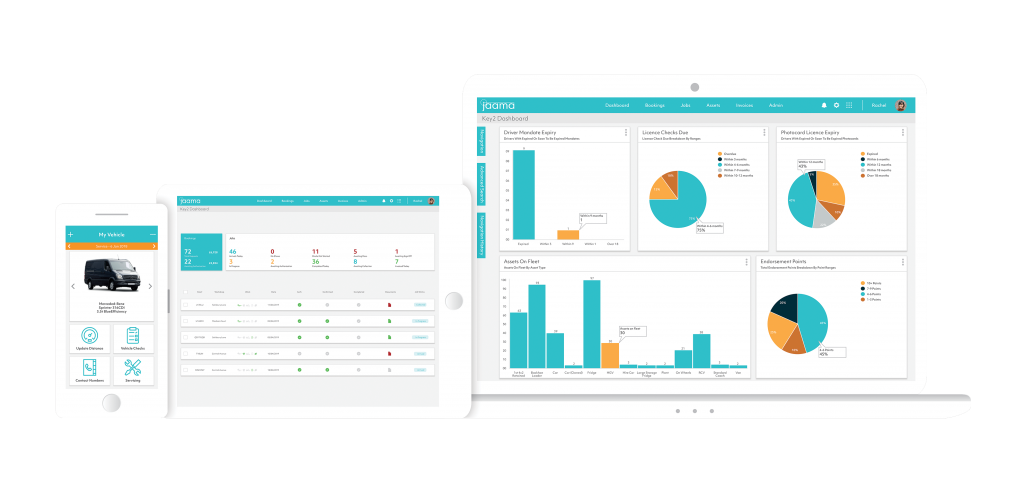

Formed in 2004, its Key2 system is its bread and butter and is said to go full Sherlock Holmes on any kind of data a fleet can throw at it. As its website says, “If you don’t measure it, you can’t manage it”.

Evans reckons that the lingering effect of the pandemic – remote working chief among them – is one of the main reasons for the uptick in business.

“If you look at what the drivers for change would typically be within the business, some of it is a bit of distress with the environment changing,” he explains, “[fleets] have got to make their operations more efficient.

“Also, I think remote working is a really big thing here, because if you look at some of the things that come with running company cars – accidents, defects and all that kind of stuff – it’s not so bad when everybody is in the office, a vehicle turns up and somebody can eyeball it.”

The firms’ app, known as MyVehicle, has proved popular for this reason. It feeds information from drivers into the Key2 system and, according to Evans, is one of the most straightforward ways of keeping tabs on vehicles that are not conveniently on-site.

“People can take pictures of their car and send them in [to the fleet department]. If they have had a puncture and they go into the office every day, they just ask somebody opposite ‘who do I go to? ATS or the leasing company?’ Nowadays, if they are working from home, they want that information served up to them within something like an app, so they do not need to call anybody. And the last thing the fleet manager wants is somebody pestering them about those sorts of things. The app takes all of that away.”

There is more to Jaama’s systems than a quick download and the company has to train users to operate them effectively. Pre-Covid would have involved extensive in-person guidance but, like much of the rest of the world; it has since established digital training programmes, which, according to Evans, often work better.

“One of the good things about it is that a lot of the companies we sell to tend to be the bigger, nationwide fleets. Quite often, when we’ve gone to see them, half the people in the fleet department will be traveling. And you think, from an environmental perspective, for one training day or whatever it is, how much CO2 is that going to use? I wouldn’t go all-out and say complete remote implementations are the way forward, but a hybrid of the two makes sense.

“Certainly, some of our customers like the idea of remote training because, as you can imagine, the fleet teams are in different places. They are often not highly paid people with company cars…and for some of them it’s a big wrench to pull them out for the day when they want to be home by a certain time, to take them to Tamworth [Jaama’s base] or somewhere else for training.”

Barring some overseas clients, for whom virtual training was necessary from a logistical perspective, Evans says the practice has been “pretty much completely online since” the pandemic for UK fleets. “It’s certainly driven the change,” he says.

Data is one of the main reasons that firm needs a proper chat with its clients before its software is properly up and running. As Evans explains, the standard and availability of it is the clincher.

“There’s a lot of configuration within our product, so it’s understanding things like what data have they got to go into the system, and what’s the quality of the data? Our product doesn’t like bad data – things like overlapping allocations – so where has that data come from, and is it any good?

“Then there is a consultancy around things like their financial year. How do they work the calendar? Do they have 12 or 13 periods in a year? What’s rechargeable, what’s not? Then we’ve got the training for the users, and we try and break that down so it’s relevant, because there’s nothing worse than a user who is only interested in one area sitting through training or something they are never going to use. It loses people pretty quickly. We all think about all of those things, but yes, prior to the pandemic that would have all happened face-to-face.”

Yet another trend thrown up by the pandemic, which again ties into remote working, is a reduction in fleet mileage. That is not news in the slightest, but Evans believes it has a knock-on effect on SMR, specifically the worth of maintenance bundles traditionally tacked onto contract hire agreements.

“I think some of our customers are looking at it from the perspective of, if they’re not doing large amounts of miles, they are spending quite a lot of money for not a lot of benefit in terms of tyres and servicing. Lots of cars nowadays don’t even need a 12 monthly service – it’s more mileage-based – so it’s certainly drives those costs down now vehicles are doing less miles.

“I think the whole concept of contracted maintenance is about de-risking it for the fleet customer. It sounds attractive – the idea of fixed costs – but then you get to the other thing, which is, ‘I’m not mitigating much of a risk here’, vehicles aren’t doing that many miles, you’re not getting through the tyres and all of that kind of stuff, so what are you trying to mitigate against?”

With the caveat that it comes from the managing director of a fleet software company, Evans reckons this is an area in which “good, solid fleet systems” prove their worth because, assuming the data is good enough, they will tell operators what is actually happening with their vehicles.

“It’s understanding the vehicle make up, the maintenance costs, what you are trying to protect, what the risks are and making sure you are on top of it. You really don’t want to be at the end of a lease or getting rid of your own vehicle, and then realise that key maintenance events haven’t been done, which is going to look pretty doubtful when you’re trying to flog it or you’re giving it back to the original leasing company.”

On the contract hire side of the fence, the firms Key2 Quotes system is attempting to tackle the still-thorny issue of ‘should I get an electric car?’. There is obviously no shortage of incentives for a company car driver to do so, but the financial lure of low benefit-in-kind and the practicalities are not the same things. As Evans explains, Jaama’s system is designed to serve up all the figures a driver would need to make the call – and also get them off the fleet manager’s back.

“You can say ‘I want a BMW 3 Series,’ and you might say, ‘I’ll have a Tesla model 3,’ or, ‘I’d like a hybrid,’ and our quotations engine does a comparison between those and will show you, side-by-side, what the costs are for the vehicles and what is means in terms of CO2 and whole-life costs.

“A lot of people in the fleet industry are pretty keen to know they’re getting an EV that’s going to be really good on benefit-in-kind [but] the non-fleet people out there aren’t so bothered with understanding what that is. Having a quotation tool, where it is there in black and white and you can see exactly what the benefit-in-kind means for your 20 or 40% taxpayer is going to help direct them towards the benefits of an electric vehicle.

“This is being used by leasing companies rather than our fleet customers, because you need quite a lot of data to populate it with enough information to make sense of it. But these sorts of tools take the work away from the fleet departments because of the way they present the data. You can pick the extras you want, and if you pick conflicting extras, it tells you. It tells you what it means in terms of P11D costs. Pretty much everything the driver needs to make his decision is there in front of him, and it should hopefully mean they are not pestering somebody at the office and saying, ‘which vehicle should I get?’.