Jaama Named Fleet Recommended 2026

We're proud to share that Jaama has been named a Fleet News Fleet Recommended ...

Stay ahead in the world of fleet and asset management with the latest insights from Jaama. Scroll to read our blog posts and learn more about industry trends, updates, success stories, and practical tips.

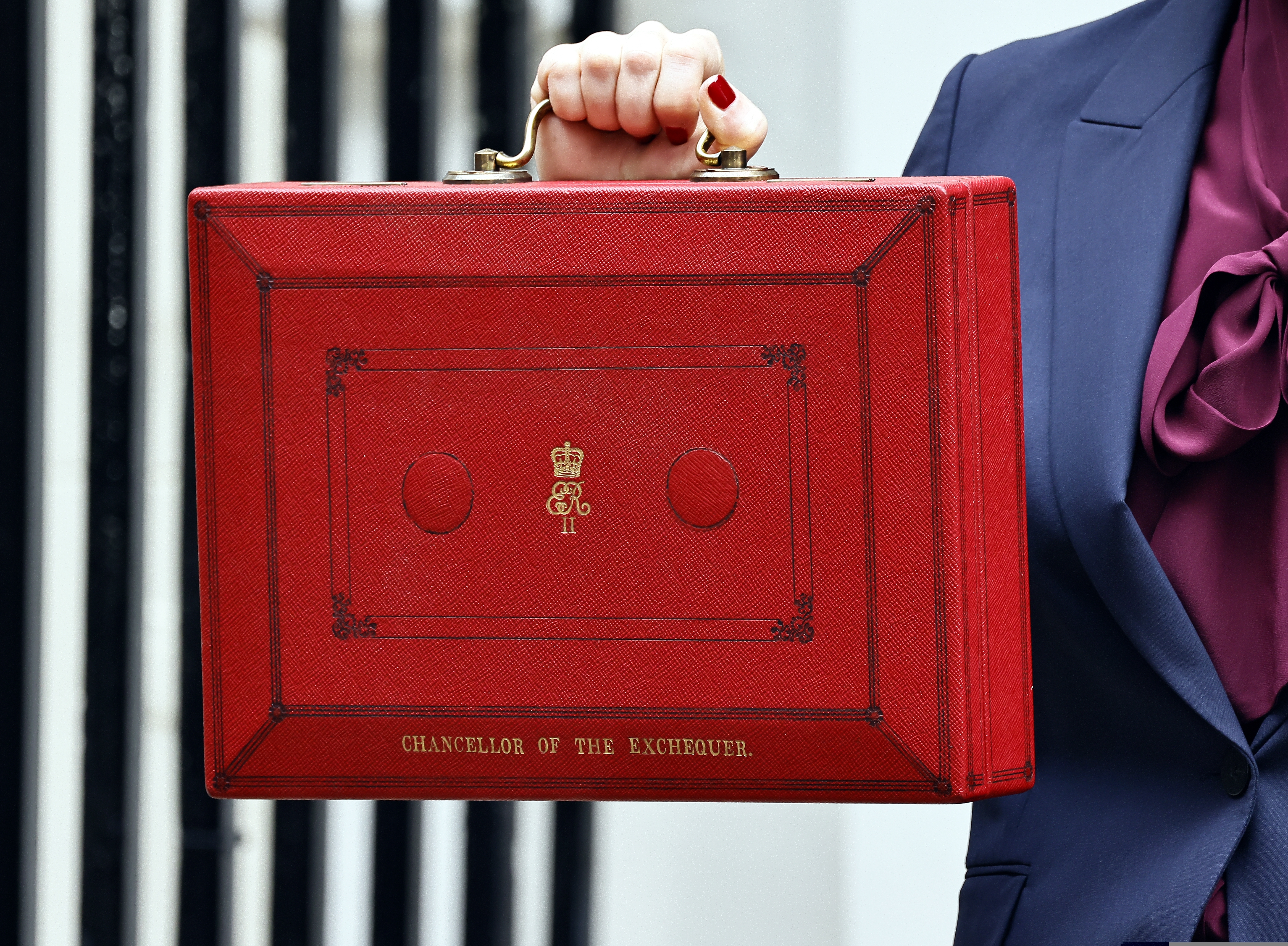

The Autumn Budget set out several taxation changes that will shape fleet planning over the coming years, particularly around future EV running costs and the timeline for fuel duty adjustments. Fleet decision-makers will already be considering how they influence whole-life costs and broader electrification strategies. 3p per mile EV tax confirmed for April 2028...

Read more

We're proud to share that Jaama has been named a Fleet News Fleet Recommended ...

About Jaama has spent over 20 years simplifying and humanising fleet ...

As we head into the festive season, we wanted to share our customer support ...

The Autumn Budget set out several taxation changes that will shape fleet ...

Transport for London has confirmed that electric vehicles will lose their full ...

We've supported the FN50 since it launched in 2006. Many of the top 50 are our ...

The latest BVRLA Leasing Outlook report highlights a fleet market in growth, ...

Over the past few years, the UK has experienced a significant shift towards ...

This week marks Road Safety Week (16-22 November), and this year's theme feels ...

Be the first to learn about the latest updates, expert tips, and industry news with the Jaama newsletter. Don’t miss out on the latest insights by subscribing below.