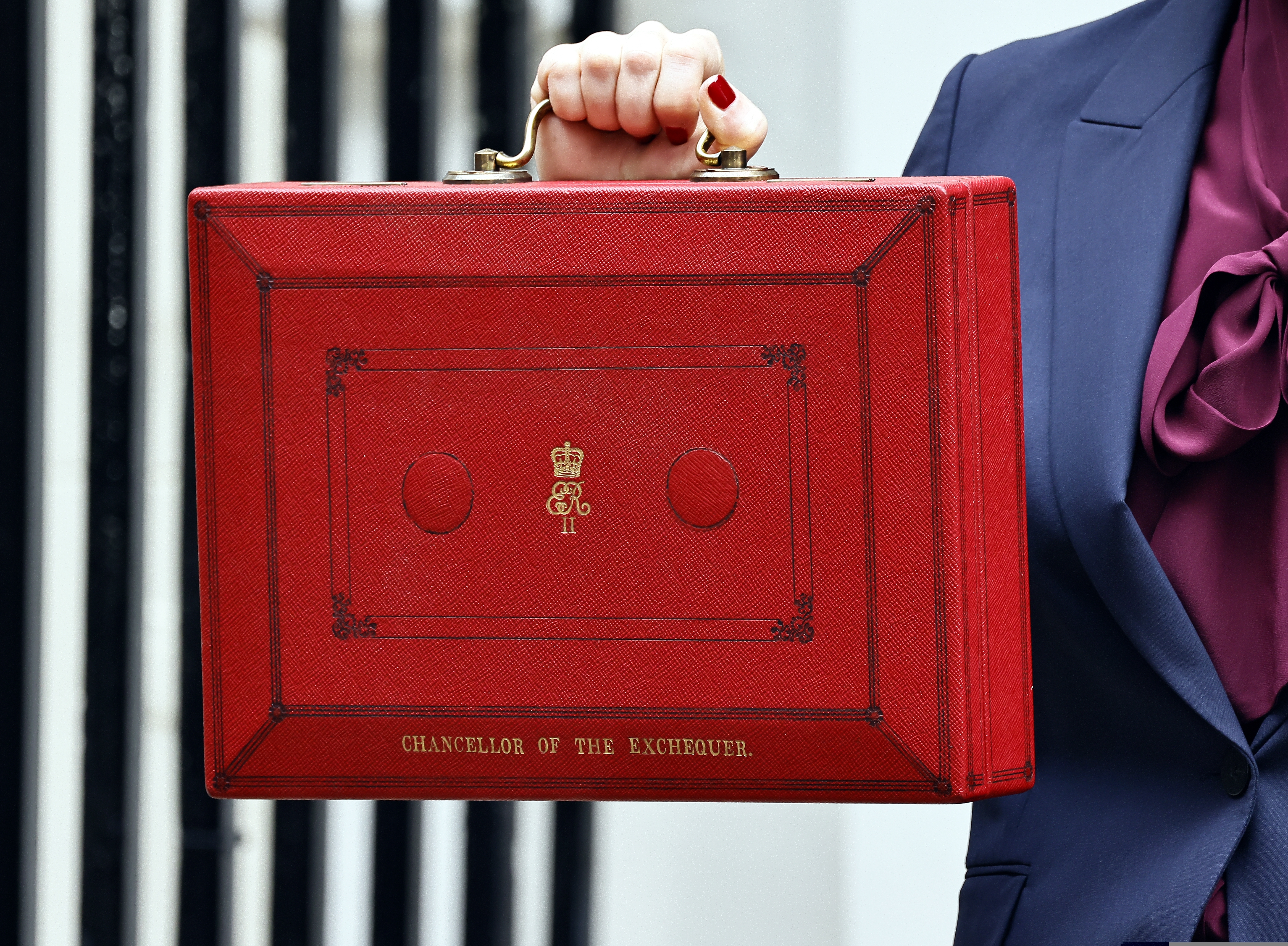

The Autumn Budget set out several taxation changes that will shape fleet planning over the coming years, particularly around future EV running costs and the timeline for fuel duty adjustments. Fleet decision-makers will already be considering how they influence whole-life costs and broader electrification strategies.

3p per mile EV tax confirmed for April 2028

The Government confirmed that from April 2028, a new mileage-based charge will apply to electric vehicles:

- 3p per mile for fully electric cars

- 5ppm for plug-in hybrids

EVs already pay the standard VED rate (£195) as of April 2025, and the new mileage-based charge will sit alongside this from 2028. Electric vans, buses and HGVs will not be liable for the charge.

For fleets, this means an additional cost to factor into EV whole-life calculations from 2028/29 onwards. While EVs will continue to deliver savings in areas such as SMR (Service, Maintenance and Repair) and Benefit-in-Kind, the per-mile road pricing structure will be essential to factor into budgeting and long-term strategies.

Fuel duty freeze extended for short-term

Fuel duty will be frozen again in April 2026 at 52.95p per litre, marking the 16th year without an increase. However, the temporary 5p per litre cut introduced in 2022 will begin to be reversed in stages from September 2026.

This means fleets running petrol and diesel vehicles can expect stable fuel duty in the short term, followed by a gradual rise back to pre-2022 levels. This staged approach is intended to maintain a running-cost differential that continues to support EV transition as the mileage-based charge is introduced.

Other measures relevant to fleets

The Expensive Car Supplement threshold for EVs will rise from £40,000 to £50,000 for vehicles registered from 1 April 2025, reducing the number subject to the £425 annual charge. The Electric Car Grant will receive an additional £1.3 billion in funding and is extended to 2029/30, with EVs eligible for grants of £3,750 or £1,500 depending on environmental criteria. A temporary BIK easement will apply for PHEVs registered from 1 January 2025 to 5 April 2028, treating their CO2 emissions as 1g/km for tax purposes.

The government will also review public EV charging costs in 2026 and provide £100 million to expand the charging network, including support for home and workplace chargers, with 10-year 100% business rates relief for businesses installing chargers.

What this means for fleets

Although most of the Budget’s measures will not take effect immediately, they give fleets a clearer view of how operating costs are likely to evolve over the next few years. Per-mile taxation for EVs will reshape whole-life cost modelling from 2028, while the short-term fuel duty freeze allows petrol and diesel fleets to plan for a predictable, staged increase in running costs. Taken together, these changes provide fleets with time to review replacement cycles, funding strategies, and EV adoption plans with a more complete picture of upcoming tax structures.